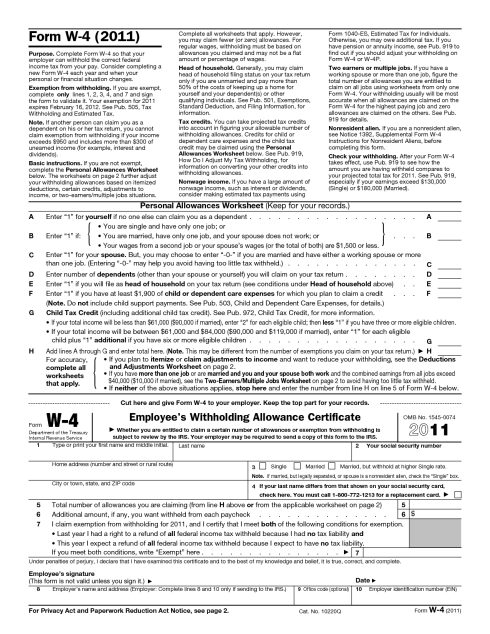

Remember filling out a W-4 form when you were first hired? It’s the form that determines how much money your employer withholds from your paycheck to pay federal and state taxes—based upon the number of “allowances” that you claimed.

But have you checked to see if it’s still applicable? Consider adjusting your W-4 form if the following applies:

- You owed the IRS money – You may want to have more money withheld from your paycheck. In fact, if you owe too much, the IRS can assess you and add a penalty for not depositing enough money into your account.

- You’ve experienced a “life change” like

- Marriage

- Divorce

- Birth or adoption of a child

- Purchase of home

- Refinance of mortgage

- Retirement

- You expect to earn money from your home-based business or other source that does not withhold income taxes from the check.

- Change in itemized deductions

- Medical expenses

- Gifts to charity

- Dependent care expenses

- Education credits

- Child tax credit

To INCREASE the amount of taxes from your paycheck, you will need to DECREASE the number of dependents. You can also specify a dollar amount—like $50 per pay period. Likewise, to have LESS money deducted, INCREASE that number.

I recommend that you check your withholding every year—right after you’ve filed your income tax return. The IRS offers a withholding calculator at www.IRS.gov and you’ll need your most recent tax return and current paycheck stub. Or, ask your tax preparer to help you adjust your withholding so you don’t own too much—or get a large refund from the IRS—at the end of the year.

Give me a call if you are purchasing a home in the near future. I will answer your questions, help you find solutions, and research the many loan options available to suit you best: http://www.utahsmortgageguy.com

Leave a comment